FX Risk Analysis

Customized currency exposure analysis

Reduce Risk.

Boost Profits.

Reduce Risk.

Boost Profits.

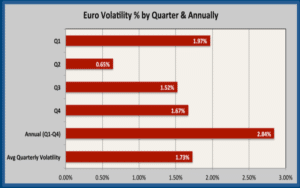

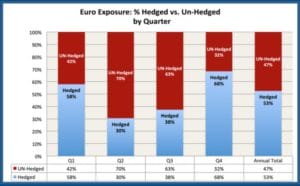

The foreign exchange risk analysis identifies pockets of risk by analyzing your global payment schedule, sales cycle and your international payment terms.

You'll receive in-depth analysis of market trends, central bank actions, and chart analytics using technical analysis and momentum indicators.

Your risk policy is a living document. Once FX risks are identified, you'll receive key takeaways to reduce risk and save you money.

A trusted FX advisor.

Over ten years in the currency markets.

Objective analysis.

A money back guarantee.

Chris Murphy is a currency market analyst and financial writer with over fifteen years experience in the financial services industry.

Vice President and Currency Risk Advisor for businesses.

Vice President of Global Markets Currency Risk Advisor for businesses and wealthy individuals.

Vice President of Global Markets Currency Risk Advisor for businesses and wealthy individuals.

Financial Service Representative. Branch banking.

Copyright © 2016 chrisbmurphy.com and Christopher B Murphy LLC. All rights reserved.