Chris Murphy

Chris Murphy's Latest Posts

S&P 500: Why 2450 Is Doable

As the S&P has surged, Treasury yields may be the barometer for any upcoming changes in the fundamentals since rising yields have been responsible for the current bull run in equities. As the fundamentals drive S&P price action by breaking key levels, the charts show the S&P is still bullish and remains in a 16% […]

Equity Analysis: Comparing Bank Of America, Wells & JPMorgan

This article containing my comparative equity analysis of Bank of America, Wells Fargo, and JPMorgan Chase & Co. for SeekingAlpha.com generated 10,000 page views.

Bank Of America: Here’s What’s Driving Earnings And The Stock

Bank stocks like Bank of America have risen and fallen on the back of Treasury yields. However, this isn’t the first time Bank of America has surged as a result of the 10-year yield. Today’s market is eerily similar to that of 2012 to 2013. By analyzing the past and the present, we can see […]

Citigroup: How The Bullish Move Might Play Out

Citigroup Inc. is trading in a bullish channel that puts resistance at $64.50 (mid-term) and $67.80 for the top of the channel. Citigroup broke out of a 4.5% range and has traveled the length of that range. The next range is currently taking shape.

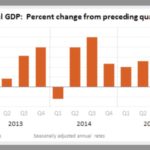

The Economy: Why The Fed Should Not Hike Rates

With the recent positive economic developments, the markets expect a rate hike from the Fed during their March meeting. However, U.S. growth is anemic with last year coming in below 2%, and growth is forecasted to be 1.3% this quarter. History has shown, the Fed has hiked rates with much higher economic growth. And U.S. […]

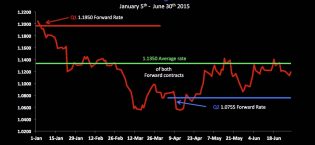

Euro Rebounds

The euro has rebounded versus the dollar rising as high as 1.1500 before retreating. Although, we’ve seen better economic data out of Europe recently, the Euro exchange rate will largely be determined by

Why Canada’s Economy Could Depreciate the Canadian Dollar

For anyone who’s investing in or sending international payments to Canada, here’s my latest article on the recent economic releases from up north. To give you an idea, Canada has not created any full-time jobs this year; all job gains have been part-time workers. The economic picture is far worse than the market has anticipated. […]

Why The Bank of England Will Cut Rates

Investors, corporate executives, and central banks eagerly await the interest rate decision by the Bank of England (BOE) scheduled for Thursday. Since a .25% rate cut is already priced into the market, the real market mover and volatility will come from the BOE statement by Mark Carney. For more of this article please click on […]

Here’s Why The Fed Is So Dovish

When the Fed held off hiking rates in July, equity markets surged. However, the credibility of the Fed eroded, due to their verbal chatter signaling a desire for higher rates leading up to their meeting, only to be followed by no action. For more on this article, please click on the image or the link […]

Why The U.S. Dollar Will Continue Marching Higher Vs. The Canadian Dollar

As crude oil remains in bearish territory, the U.S. dollar (USD) will likely continue its march higher vs. the Canadian dollar (CAD). The correlation between USD/CAD and Crude Oil exists because Canada is an oil exporting country and derives revenue and job growth from oil exports. For more of this article and why the USD […]