Bank Stock Analysis

Reasons To Be Bullish Bank Stocks In 2018

In this analysis, we review the economic and financial backdrop that supports bank stocks in 2018. Originally published on SeekingAlpha.com. Please click on the image or the title link: Don’t forget to sign up for email alerts to have my free articles emailed to you. (see sidebar) Reasons To Be Bullish Bank Stocks In 2018 […]

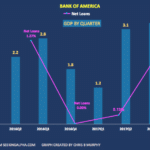

The Treasury Yield Values That Could Push Bank Of America To $35

With the recent fall in yields, banks have retraced somewhat in the short-term. Historically, yields have translated to higher bank stock prices against a backdrop of solid economic growth. In this article, we’ll show where yields have typically traded as compared to Bank of America’s stock price and that the long-term prospects look good. For […]

Bank Of America: Why You Can Bank On $29

Bank of America has rallied in September, and bullish momentum is building in the stock. The long-term charts show that BofA might be following a similar trading pattern that played out in Q4 of last year. By analyzing the long-term charts, we can get a better sense of the trend and whether there’s sustaining momentum […]

Wells Fargo: CEO Fires Warning Shots

The Wells Fargo sales scandal lingers on and is likely to be a drag on the stock price in the coming months. CEO, Tim Sloan warned of three areas that might impact Q3 earnings. The stock price has been helped by a hawkish Fed, but whether that’ll continue to prop up the stock is yet […]

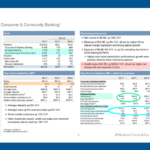

JPMorgan: What’s Driving Revenue

It’s no secret that JPMorgan beat estimates for Q3. In this analysis, we’ll delve into a division for the bank that is helping to drive revenue and will likely be a key factor in the coming quarters. The Consumer Banking division at JPMorgan is putting up great numbers and is helping to diversify the bank’s […]

Citigroup To Rise To $80

Citigroup beat its Q3 EPS estimates. The stock is up over 7.5% since September 1st. We’ll analyze how the stock could push higher perhaps to $80 in the near future. Please click on this link for the full article.

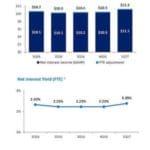

The Fed To Drive Bank Stocks Like Bank Of America

Historically, as yields have risen, so too have bank stocks. We’re already seeing moves higher in financials as a result of anticipation of a Fed rate hike. However, it’s the balance sheet reduction that’ll likely drive banks higher in the medium to long-term. Please click on this link for the full article.

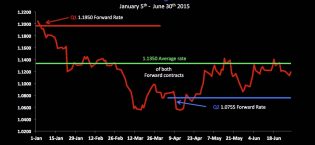

How Bank Of America & Yields Have Moved After Fed Hikes

Typically, as yields rise, so too do bank stocks. It may seem surprising (at least it was to me) that the 10-year yield has fallen in the days following the last three Fed hikes. As a result, bank stocks like Bank of America have corrected in lock step. If you recall, the value of the […]

Bank of America Historical Indicators Of Corrections (Featured On MSN Money)

My equity analysis of Bank Of America, published on SeekingAlpha.com, generated over 17,000 page views and was featured on MSN Money.

Bank Of America: Why Moynihan Fired The Shot Heard Around The Markets

Brian Moynihan, the CEO of Bank of America (NYSE:BAC), fired a warning shot to investors last week when he said that Q2 results might come in lower than expected.

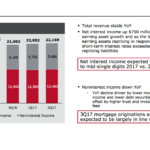

Why Bank Of America’s Q1 Earnings Soared & Why Q2 Might Disappoint

Bank of America reported better-than-expected Q2 earnings largely due to higher Treasury yields. Net interest income is a key driver for earnings, and our analysis of Q1 yields, we showed how Q1 NII would surpass expectations.

Comparing The P/E Ratios Of Bank Of America, JPMorgan Chase, And Wells Fargo

Bank of America’s P/E ratio has fallen back to earth to 14.5 versus 17 just before the Fed hike in March and has fallen 12% YTD. Forward P/Es for JPMorgan Chase, Wells Fargo, and Bank of America have recently converged.