Writing Services Offered

My writing services include articles, blog posts, newsletters, Powerpoints, and market analysis. Let me help you with improving your brand awareness.

My writing services include articles, blog posts, newsletters, Powerpoints, and market analysis. Let me help you with improving your brand awareness.

If you need to create an image from a table or set of data in Excel, here’s a quick way of getting around printing the whole file in preview which can often be cumbersome and slow your computer. In Excel, highlight the cells of the table you want as an image. Click File; Select Print […]

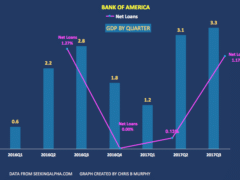

Here are a few of my top trending articles and the sites and search engines that featured them. For example, my equity analysis for Bank of America on March 2nd was the top search result on Google for Bank of America stock news. Top search results improve your websites’ Search Engine Optimization translating to more article clicks and increased brand awareness.

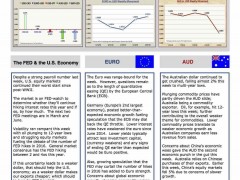

In this analysis, we review the economic and financial backdrop that supports bank stocks in 2018. Originally published on SeekingAlpha.com. Please click on the image or the title link: Don’t forget to sign up for email alerts to have my free articles emailed to you. (see sidebar) Reasons To Be Bullish Bank Stocks In 2018 […]

Typically, as yields rise, so too do bank stocks. It may seem surprising (at least it was to me) that the 10-year yield has fallen in the days following the last three Fed hikes. As a result, bank stocks like Bank of America have corrected in lock step. If you recall, the value of the […]

Here are a few of my top trending articles and the sites and search engines that featured them. For example, my equity analysis for Bank of America on March 2nd was the top search result on Google for Bank of America stock news. Top search results improve your websites’ Search Engine Optimization translating to more article clicks and increased brand awareness.

In this analysis, we review the economic and financial backdrop that supports bank stocks in 2018. Originally published on SeekingAlpha.com. Please click on the image or the title link: Don’t forget to sign up for email alerts to have my free articles emailed to you. (see sidebar) Reasons To Be Bullish Bank Stocks In 2018 […]

With the recent fall in yields, banks have retraced somewhat in the short-term. Historically, yields have translated to higher bank stock prices against a backdrop of solid economic growth. In this article, we’ll show where yields have typically traded as compared to Bank of America’s stock price and that the long-term prospects look good. For […]

Bank of America has rallied in September, and bullish momentum is building in the stock. The long-term charts show that BofA might be following a similar trading pattern that played out in Q4 of last year. By analyzing the long-term charts, we can get a better sense of the trend and whether there’s sustaining momentum […]

When it comes to retirement planning, we’re taught to plan for the long term. Over many years, the markets should perform well and on average deliver a stable rate of return. However, there are risks that can quickly derail your chances of having enough saved for retirement.

Comparing Rental Properties And REITs With interest rates low and uncertainty surrounding the stock market, retirees are turning to real estate to generate income. It’s estimated that one in ten retirees supplement their income with rental properties. REITs are also an attractive option for investing in real estate. In this article, we’ll break down the […]

A dividend income strategy can provide you with a fairly predictable monthly income stream. The dividends are the result of investments in a mix of stocks of stable companies. There are many benefits to the dividend income strategy including it can be tailored to your meet your need-expenses in retirement.

Here’s the slideshow of the highlights from my latest Education Video for Forward Contracts. The video utilizes the dollar-cost-averaging concept and combines it with hedging currency exchange rates. However, this can be modified to accommodate educating clients about personal finance, how the financial markets function, and investment strategies; i.e. retirement 401Ks and IRAs. […]

A Special Report is a great content marketing tool to reach out to prospects and showcase your know-how. Aided by visually stunning charts, your report can stand out from your competition!

Don’t have time to write a weekly newsletter? Don’t worry. You’ve already written it! Enclosed are 6 reasons you should be writing a weekly or monthly newsletter. Why not repurpose your daily FX updates and create a more in-depth weekly outlook that your business clients will look forward to?

There’s an old writing adage: “Show, don’t tell.” To build brand awareness, showcase your team’s expertise

By creating a landing page, you can showcase a specific service to prospective clients. Check out my new Currency Market Risk Analysis landing page which offers a service and a fee structure. Landing pages and content marketing go hand-in-hand. Please contact me and we can tailor the subject matter in the landing page by industry or […]

Here’s a sample pitch-book that I wrote for Huntington Bank Capital Markets. Let me create a library of powerpoint pitch-books that can be standardized for you and your team? Here’s just a few of the services I offer: Create a powerpoint library revamped with new charts and market updates. Create a pitch-book for each currency […]

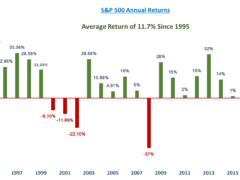

When it comes to retirement planning, we’re taught to plan for the long term. Over many years, the markets should perform well and on average deliver a stable rate of return. However, there are risks that can quickly derail your chances of having enough saved for retirement.

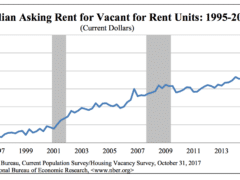

Comparing Rental Properties And REITs With interest rates low and uncertainty surrounding the stock market, retirees are turning to real estate to generate income. It’s estimated that one in ten retirees supplement their income with rental properties. REITs are also an attractive option for investing in real estate. In this article, we’ll break down the […]

A dividend income strategy can provide you with a fairly predictable monthly income stream. The dividends are the result of investments in a mix of stocks of stable companies. There are many benefits to the dividend income strategy including it can be tailored to your meet your need-expenses in retirement.

This article details the pros and cons of building retirement income with a bond ladder. I co-authored this post as part of a retirement income series with Bradley Clark, Certified Financial Planner of Clark Asset Management, LLC. A Bond Ladder Matches Income To Your Financial Needs. When planning your retirement, determining how much money you need […]

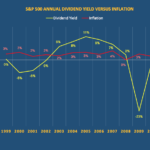

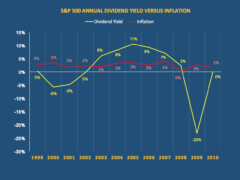

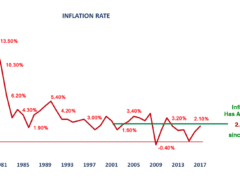

Inflation erodes the rate of return on your retirement portfolio over time. Some investments are affected more so than others by rising prices. However there are solutions available to help you win the fight against inflation.

My writing services include articles, blog posts, newsletters, Powerpoints, and market analysis. Let me help you with improving your brand awareness.

In this analysis, we review the economic and financial backdrop that supports bank stocks in 2018. Originally published on SeekingAlpha.com. Please click on the image or the title link: Don’t forget to sign up for email alerts to have my free articles emailed to you. (see sidebar) Reasons To Be Bullish Bank Stocks In 2018 […]

If you need to create an image from a table or set of data in Excel, here’s a quick way of getting around printing the whole file in preview which can often be cumbersome and slow your computer. In Excel, highlight the cells of the table you want as an image. Click File; Select Print […]

With the recent fall in yields, banks have retraced somewhat in the short-term. Historically, yields have translated to higher bank stock prices against a backdrop of solid economic growth. In this article, we’ll show where yields have typically traded as compared to Bank of America’s stock price and that the long-term prospects look good. For […]

Bank of America has rallied in September, and bullish momentum is building in the stock. The long-term charts show that BofA might be following a similar trading pattern that played out in Q4 of last year. By analyzing the long-term charts, we can get a better sense of the trend and whether there’s sustaining momentum […]