Why Bank Of America’s Q1 Earnings Soared & Why Q2 Might Disappoint

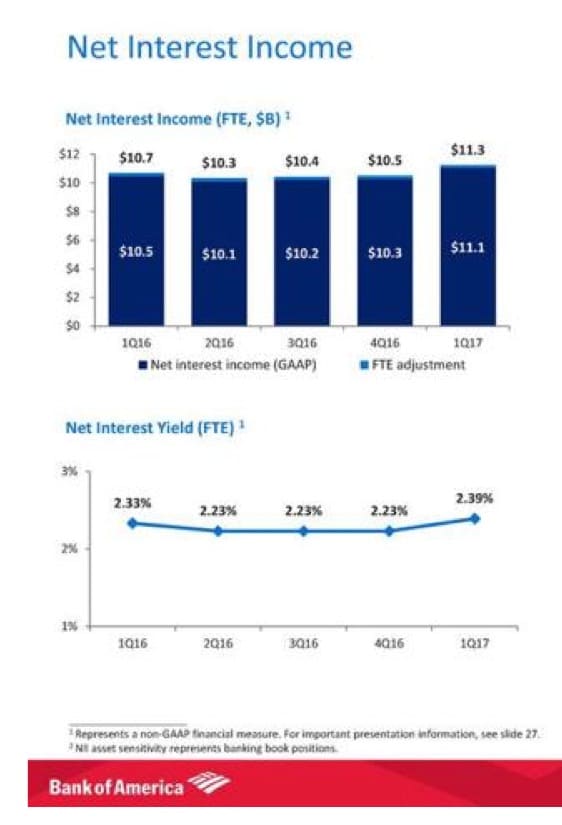

Bank of America reported better-than-expected Q2 earnings largely due to higher Treasury yields. Net interest income is a key driver for earnings, and our analysis of Q1 yields, we showed how Q1 NII would surpass expectations.

However, yields have fallen, narrowing the 2-to-10-year yield spread which typically translates to waning optimism in the economy. Waning optimism about economic growth and lower yields may put pressure on bank stocks in the short-term.

For the full article, please click on the link below:

Why Bank Of America’s Q1 Earnings Soared And Why Q2 Might Disappoint

Don’t forget to sign up for my FREE EMAIL ALERTS ON BANK STOCKS BELOW!